Housing Policy was the hot topic at the Federal Budget meeting earlier this month.

Honestly, I am fully in support of the Government taking initiative in tackling this housing crisis, but I don't see a lot of substance to what they are proposing.

Let's start with Foreign Investment. The Government is proposing to stop offshore buyers from purchasing any type of property (except recreational) for 2 years. However, this does not apply to foreign students, permanent residents, foreign workers, or foreigners who are purchasing their primary residence in Canada.

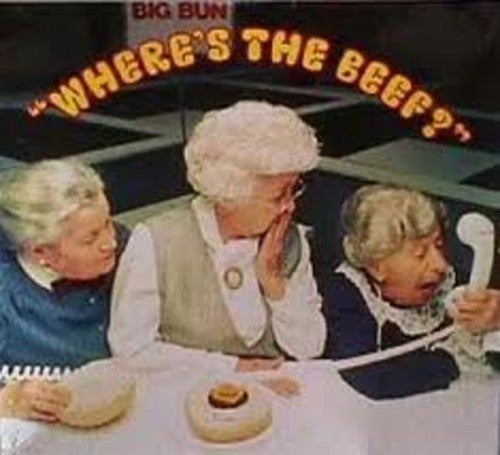

My question is - who does this actually apply to!? There's no official start date and it's full of loopholes.

Furthermore, the past 2 years have shown us that Canada wide home prices escalated all on their own without foreign money. In fact, some areas saw home values double over the past 2 years!

Bottom line, the impact of a foreign buyer ban would be minimal, borderline insignificant.

Next up, building and flipping. Starting in 2023, anyone who purchases a home and sells it within a year is subject to paying full business tax and will not qualify for a primary residence exemption.

Anyone in the house flipping business is already paying tax as a business anyway. There will be exceptions for Canadians selling their home due to life circumstances such as a death, disability, the birth of a child, a new job, or a divorce.

Honestly, I am fully in support of the Government taking initiative in tackling this housing crisis, but I don't see a lot of substance to what they are proposing.

My question is - who does this actually apply to!? There's no official start date and it's full of loopholes.

Furthermore, the past 2 years have shown us that Canada wide home prices escalated all on their own without foreign money. In fact, some areas saw home values double over the past 2 years!

Bottom line, the impact of a foreign buyer ban would be minimal, borderline insignificant.

Next up, building and flipping. Starting in 2023, anyone who purchases a home and sells it within a year is subject to paying full business tax and will not qualify for a primary residence exemption.

Anyone in the house flipping business is already paying tax as a business anyway. There will be exceptions for Canadians selling their home due to life circumstances such as a death, disability, the birth of a child, a new job, or a divorce.

This legislation also excludes permanent residents, foreign workers, foreigners buying their primary residence, and students (??).

How about the Housing Accelerator Fund? The Government plans to set aside $4 Billion over the next 5 years starting sometime this year or in 2023 to add to housing stock. This is fantastic! We need more housing supply - that's our biggest problem.

How about the Housing Accelerator Fund? The Government plans to set aside $4 Billion over the next 5 years starting sometime this year or in 2023 to add to housing stock. This is fantastic! We need more housing supply - that's our biggest problem.

The goal is to help municipalities build 100,000 new units (homes) over the next 5 years.

The budget states

The fund will be designed to be flexible to the needs and realities of cities and communities, and could include support such as an annual per-door incentive for municipalities, or up- front funding for investments in municipal housing planning and delivery processes that will speed up housing development."

However, we still have a labor shortage and until the permit process is somehow sped up with the City we remain in a holding pattern. Yes, we are targeting 100,000 new immigrants in 2022 which will add to the labor force, but we also need to house them!

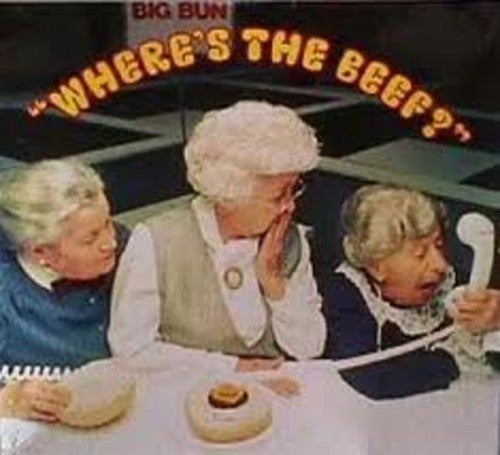

There are still very few details on how this plan is to be executed, so it all sound like a lot of political fluff with very little substance.

The market is already cooling off all on it's own due to rising borrowing costs and exhausted buyers taking a breather on the sidelines. The timing of these policies just happens to coincide with this and will no doubt look good on a political platform.