If you're thinking of buying or selling a home this information is extremely valuable. I can help you with understanding the market in an area you're looking to sell or buy in... remember the stats that the media reports are simply too broad. There are many markets within markets in the Lower Mainland.

Several factors influence the housing market, including mortgage interest rates, inflation, employment, investment, construction, immigration, government assistance programs, and the health of local and world economies. All of these influence the supply and demand of the market which, in turn, affects prices.

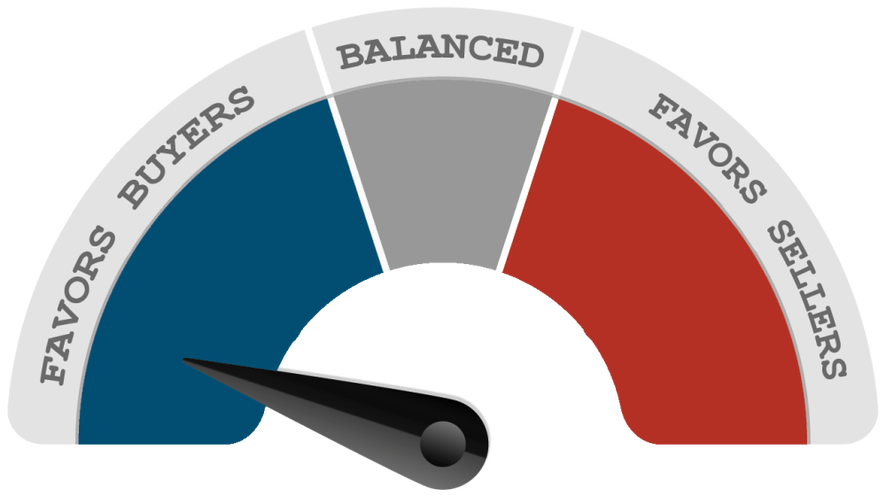

There are three classifications experts use to describe the balance of supply and demand in the housing market:

Seller's market

A seller’s market is when there are more people looking to buy then there are homes available. This causes a rise in price above the long-term average rate of inflation. Typically this is indicated by a sales-to-active listings ratio of 20% or higher.Buyer's market

In contrast, a buyer’s market is when there are more homes for sale than there are buyers. As a result, prices typically either decrease or increase at a pace below the average rate of inflation. A buyer's market occurs when the sales-to-active listings ratio dips below 12%.Balanced market

A balanced market occurs when supply and demand are about the same, with home prices rising in line with long-term average rate of inflation. Typically this is indicated by a sales-to-active listings ratio between 12% and 20%.Over a sustained period of time:

a seller's market is represented by a ratio of 20% or higher

a buyer's market is represented by a ratio of 11% or lower

a balanced market rests between 12-19%

a buyer's market is represented by a ratio of 11% or lower

a balanced market rests between 12-19%